Form 3115 Instructions: A Comprehensive Overview

Form 3115, the Application for Change in Accounting Method, requires detailed instructions for navigating alterations to a business’s financial reporting. Taxpayers utilize this IRS form to request changes, impacting overall or specific item accounting.

What is Form 3115?

Form 3115, officially titled “Application for Change in Accounting Method,” is a crucial document issued by the Internal Revenue Service (IRS). It serves as the formal request mechanism for any taxpayer – individuals, corporations, partnerships, or estates – seeking to modify their established accounting practices. These modifications can encompass a complete overhaul of the overall accounting method employed or adjustments to the accounting treatment of specific items within their financial records.

Essentially, it’s the gateway for businesses to transition to a different way of reporting income and expenses to the IRS. This isn’t a simple administrative task; it requires careful consideration and adherence to specific IRS guidelines. The form itself, along with its accompanying instructions, details the necessary information and procedures for a valid submission. Understanding the nuances of Form 3115 is paramount for ensuring compliance and avoiding potential penalties. It’s a key component of maintaining accurate tax reporting and financial transparency.

Purpose of Filing Form 3115

The primary purpose of filing Form 3115 with the IRS is to officially request permission to alter a taxpayer’s accounting method. This isn’t an automatic approval; the IRS requires justification and a detailed plan for the change. Businesses might seek a change to improve accuracy, reflect their economic reality more effectively, or comply with evolving tax laws and regulations.

Changes can range from adopting a new depreciation method to altering how inventory is valued. Filing Form 3115 ensures the change is documented and approved, preventing discrepancies during audits. It also allows the IRS to assess the potential impact on tax liability. Taxpayers must demonstrate the new method clearly reflects income and avoids material distortions.

Furthermore, the form facilitates a consistent and transparent transition, outlining how prior periods will be adjusted, if necessary. Properly utilizing Form 3115 and its instructions is vital for maintaining compliance and avoiding penalties associated with unauthorized accounting method changes.

Who Needs to File Form 3115?

Generally, any business entity – including corporations, partnerships, and sole proprietorships – contemplating a change in its accounting method is required to file Form 3115 with the IRS. This encompasses alterations to either the overall accounting method or the accounting treatment of a specific item. It’s not limited to large corporations; even smaller businesses making adjustments need to adhere to this process;

Specifically, if a taxpayer switches from the cash to the accrual method, or changes depreciation methods, Form 3115 is essential. Those adopting a new method due to a change in tax law or IRS guidance also must file. The instructions emphasize that even seemingly minor adjustments require formal approval.

Entities undergoing mergers or acquisitions often need to file to harmonize accounting practices. It’s crucial to determine if the proposed change requires Form 3115; consulting the IRS publications and potentially a tax professional is advisable to ensure compliance and avoid potential penalties.

Overall Accounting Method vs. Item Accounting Method

Understanding the distinction between overall and item accounting methods is crucial when completing Form 3115. An overall accounting method dictates how a business tracks income and expenses – for example, the shift from cash to accrual accounting represents a change to the entire system.

Conversely, an item accounting method pertains to specific aspects of financial reporting. This could involve altering the depreciation method used for assets, changing the way inventory costs are determined, or modifying how bad debts are handled. These adjustments don’t impact the fundamental accounting system but refine specific calculations.

The IRS instructions for Form 3115 require different levels of detail depending on whether the change is overall or item-specific. Overall method changes typically necessitate a more comprehensive explanation of the impact on financial statements. Item changes, while still requiring justification, are generally less extensive in their reporting requirements.

Understanding Accounting Method Changes

Accounting method changes aren’t undertaken lightly; they require careful consideration and adherence to IRS guidelines outlined in the Form 3115 instructions. These changes can stem from evolving business practices, updated tax laws, or a desire for more accurate financial reporting.

The IRS generally requires a valid business purpose for any proposed change. Simply preferring one method over another isn’t sufficient justification. Acceptable reasons include improved reflection of income, compliance with generally accepted accounting principles (GAAP), or alignment with industry standards.

Furthermore, the IRS scrutinizes the potential impact on tax liability. Changes must be made in a consistent manner, and any resulting adjustments to prior-year returns must be clearly documented. Revenue procedures and rulings often provide specific guidance on permissible changes and their implementation. Thoroughly reviewing these publications is essential before filing Form 3115.

IRS Guidance and Form 3115

Navigating Form 3115 effectively demands a comprehensive understanding of current IRS guidance. The IRS frequently issues revenue procedures, revenue rulings, notices, and other publications that directly impact the application and interpretation of accounting method change rules. These resources clarify acceptable methods, required documentation, and potential consequences of non-compliance.

Taxpayers must diligently research any new published guidance before submitting Form 3115. The IRS website (IRS.gov) serves as the primary repository for this information. Ignoring recent updates can lead to rejected applications or, worse, penalties.

The Form 3115 instructions themselves reference relevant sections of the Internal Revenue Code and point to key IRS publications. However, these instructions aren’t exhaustive. Proactive research is crucial. Staying informed about evolving IRS positions ensures a smoother and more successful accounting method change process, minimizing potential audit risks.

Section References and the Internal Revenue Code

Form 3115’s foundation rests firmly within the framework of the Internal Revenue Code (IRC). The instructions explicitly state that section references pertain to the IRC unless otherwise noted. Understanding these references is paramount for accurate completion and justification of requested accounting method changes.

Key IRC sections frequently cited in conjunction with Form 3115 include those governing permissible methods, the requirement for IRS approval, and the computation of adjustments resulting from the change. These sections define the boundaries within which taxpayers can operate and dictate the procedures for implementing a new accounting method.

Taxpayers aren’t expected to be legal experts, but a basic familiarity with relevant IRC sections is essential. Consulting with a qualified tax professional is highly recommended to ensure compliance. Proper referencing demonstrates due diligence and strengthens the application’s validity, minimizing potential scrutiny during an IRS review.

Required Information to Include with Form 3115

Submitting a complete Form 3115 necessitates meticulous attention to detail regarding required information. Beyond the basic taxpayer identification details, a comprehensive explanation of the proposed change is crucial. This includes identifying the old and new accounting methods, and a clear rationale for the switch.

The IRS demands a detailed analysis of the impact the change will have on taxable income for each affected tax year. This requires calculations demonstrating the adjustments needed, and a schedule outlining the cumulative effect over time. Supporting documentation, such as financial statements and relevant correspondence, is often necessary.

Furthermore, taxpayers must disclose any relevant revenue procedures, rulings, or court cases supporting their request. Failing to provide all necessary information can lead to delays or rejection. The instructions emphasize including all pertinent data, even if not explicitly requested, to facilitate a smooth review process.

Form 3115: Detailed Instructions

The Form 3115 instructions, though potentially complex, are vital for successful accounting method changes. The IRS provides a section-by-section guide, detailing each entry required on the form. Careful adherence to these guidelines is paramount, as even minor errors can cause processing delays or rejection.

A key component involves accurately completing Schedule A, which outlines the details of the proposed change. This includes specifying the applicable Internal Revenue Code section and providing a clear explanation of the method’s impact. Taxpayers must also determine the appropriate method for applying the change – retrospective adjustment or a change on a prospective basis.

The instructions emphasize the importance of consulting relevant revenue procedures and rulings. These publications often provide specific guidance on acceptable methods and limitations. Thoroughly reviewing these resources, alongside the form’s instructions, ensures compliance and minimizes potential issues during the IRS review process.

Navigating Accounting Method Changes with Form 3115

Successfully navigating accounting method changes with Form 3115 demands meticulous preparation and a thorough understanding of IRS regulations. The process begins with identifying the desired change and confirming its permissibility under the Internal Revenue Code. Careful consideration must be given to the potential tax impact, both immediate and long-term.

Filing Form 3115 isn’t merely a procedural step; it’s a formal request requiring justification. Taxpayers must clearly articulate the reasons for the change, demonstrating a legitimate business purpose. The IRS scrutinizes these explanations, ensuring they align with established guidelines.

Furthermore, understanding the difference between overall and item accounting method changes is crucial. Each requires specific documentation and may trigger different consequences. Staying updated on recent revenue procedures and rulings is also essential, as the IRS frequently issues guidance impacting these changes.

Recent Updates to Form 3115

While the core function of Form 3115 – requesting accounting method changes – remains consistent, the IRS periodically updates related guidance impacting its application. As of late 2024 and early 2026, taxpayers should be aware of evolving interpretations regarding permissible changes and required documentation. Staying current is paramount for compliant filing.

Recent announcements from the IRS emphasize the importance of aligning method changes with current revenue procedures and rulings. These updates often clarify ambiguous areas or introduce new limitations. The IRS also continues to promote its free tax filing options through IRS.gov, potentially offering resources for navigating complex changes.

Taxpayers should diligently monitor the IRS website for new publications and notices related to Form 3115. Changes can affect the timing of filings, acceptable justifications, and potential penalties for non-compliance. Proactive awareness ensures a smoother process and minimizes risk.

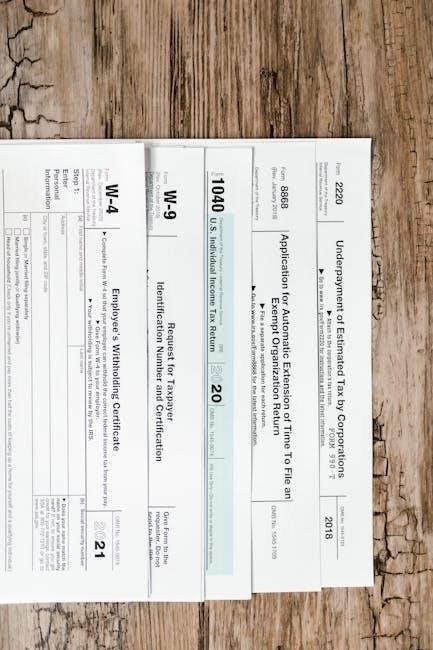

Related IRS Forms

Successfully navigating Form 3115, Application for Change in Accounting Method, often necessitates familiarity with several other IRS forms and publications. Form 1120, U.S. Corporation Income Tax Return, and Form 1065, U.S. Return of Partnership Income, are frequently used in conjunction with Form 3115, as accounting method changes directly impact these filings.

Furthermore, Form 4562, Depreciation and Amortization, may be relevant if the accounting method change involves alterations to depreciation schedules. Taxpayers should also consult IRS Publication 535, Business Expenses, for guidance on deductible expenses affected by the change. Understanding these interconnected forms is crucial.

Depending on the nature of the change, other forms like Form 8832, Entity Classification Election, might also be pertinent. Thoroughly reviewing the Form 3115 instructions and related IRS guidance will reveal any additional required forms, ensuring complete and accurate submissions.

Filing Form 3115: Step-by-Step Guide

Initiating the Form 3115 process requires careful adherence to a structured approach. First, meticulously complete all sections of the form, providing detailed explanations for the proposed accounting method change. Accurate information is paramount. Next, calculate the adjustment required under Section 481, detailing the impact on taxable income.

Attach Form 3115 to your timely filed income tax return – or amended return – for the year in which the change becomes effective. Include all supporting documentation, such as detailed calculations and relevant revenue procedures. Remember to retain copies for your records.

The IRS emphasizes the importance of referencing applicable revenue procedures and rulings. Finally, ensure the form is properly signed and dated. Following these steps diligently will facilitate a smoother review process and minimize potential complications. Consult the official IRS instructions for the most current guidance.

Potential Consequences of Incorrect Filing

Submitting an inaccurate or incomplete Form 3115 can trigger several adverse consequences from the IRS. The agency may disallow the requested accounting method change, forcing continued use of the existing method. This can lead to ongoing compliance burdens and potentially unfavorable tax outcomes.

Furthermore, the IRS could assess penalties for negligence or substantial understatement of tax if the incorrect filing results in an underpayment. Audits are also more likely when accounting method changes are improperly documented or justified. Delays in processing your return are another potential outcome.

It’s crucial to remember that taxpayers bear the responsibility for accurate filing. Thoroughly review the Form 3115 instructions and seek professional tax advice if needed. Ignoring these precautions could result in significant financial repercussions and increased scrutiny from the IRS.

Taxpayer Responsibilities When Filing

When submitting Form 3115, taxpayers assume significant responsibilities to ensure accuracy and compliance. Primarily, a complete understanding of the proposed accounting method change is vital, alongside its impact on tax liability. Thorough documentation supporting the change, including calculations and justifications, is essential.

Taxpayers must diligently review the latest IRS guidance – revenue procedures, rulings, and notices – as these can influence the acceptability of a proposed method. They are obligated to disclose all relevant information, even if not explicitly requested on the form itself. Maintaining accurate records related to the change is crucial for potential audits.

Furthermore, taxpayers must determine if the change requires IRS approval before implementation. Failing to adhere to these responsibilities can lead to penalties and rejection of the requested accounting method. Proactive research and professional assistance are highly recommended.

Impact of Revenue Procedures and Rulings

IRS Revenue Procedures and Rulings exert a substantial influence on Form 3115 filings, dictating the permissibility and implementation of accounting method changes. These publications provide detailed guidance, clarifying acceptable methods and outlining specific requirements for their application. Taxpayers must consult current rulings before submitting a form.

Revenue Procedures often establish safe harbors, allowing automatic approval for changes meeting defined criteria. Conversely, rulings address unique situations, offering interpretations of tax law applicable to specific cases. Ignoring these directives can result in rejected applications and potential penalties.

Changes in published guidance frequently necessitate adjustments to proposed accounting methods. Taxpayers are responsible for staying abreast of updates and ensuring their Form 3115 reflects the latest IRS position. Proactive monitoring of IRS.gov is crucial for successful navigation of these complex regulations.

Free Tax Filing Options through IRS.gov

While Form 3115 itself doesn’t directly fall under free filing programs, IRS.gov offers valuable resources to assist taxpayers navigating complex tax matters, including accounting method changes. The “Free Tax USA” and similar services primarily focus on standard tax returns, not specialized forms like 3115.

However, IRS.gov provides comprehensive guidance, publications, and instructions for Form 3115, accessible at no cost. This includes detailed explanations of accounting methods, eligibility requirements, and the proper completion of the form. Taxpayers can download necessary forms and publications directly from the website.

Furthermore, the IRS offers free assistance through its Taxpayer Assistance Centers (TACs). While appointments are often required, these centers provide personalized support from IRS representatives, potentially aiding in understanding Form 3115 requirements. Utilizing these resources can significantly simplify the filing process, even without direct free filing assistance for the form itself.

Resources for Further Assistance

Navigating Form 3115 and accounting method changes can be complex. Beyond IRS.gov’s official instructions, numerous resources offer supplementary support. Professional tax advisors, including Certified Public Accountants (CPAs) and enrolled agents, possess specialized knowledge to guide taxpayers through the process.

The IRS’s Taxpayer Assistance Centers (TACs) provide in-person assistance, though appointments are generally necessary. These centers can clarify form requirements and address specific questions. Additionally, the IRS offers telephone assistance, though wait times may vary.

Several online tax resources and forums provide communities for discussing tax-related issues, including Form 3115. While these forums aren’t official IRS channels, they can offer valuable insights from other taxpayers and professionals. Remember to verify information obtained from unofficial sources with official IRS guidance. Consulting with a qualified tax professional remains the most reliable approach for complex situations.